So I tried to put together a fairly simple way to help pick.

WHAT TO AVOID

1) Avoid Return Chasing.

Probably one of the worst things you can do is filter by 3, 5 and 10 year returns and pick the one that has the highest return. It’s been proven over and over again that “past performance is no guarantee of future results. Actually in many cases the reverse is true. The better the past returns, the more people tend to pile in and thus the price of the investment has gone up a lot meaning that a normal “regression to the mean” will cause future performance to be worse.

Don’t get clever and try to buy the worst performing funds either because many funds disappear completely leaving the investor with $0.

2) Avoid Making things complex.

I think it’s wise to stick to 2-4 funds. Anything more gets really messy and complicated. You have to start thinking about which companies the funds hold and in what %, because there might be lots of investment overlap. You have to understand the different strategies used by the different fund managers. You have pay more attention to which indexes they compare themselves against. Additionally this generally has very little effect on long term overall performance of the investment, and it leads to “activity” by the investor that is almost always negative for returns.

3) Avoid looking at it too much.

In many situations monitoring and information are powerful tools. In investing they can be just as effective as blowing you up and giving you increased performance. Money has a huge impact on our emotions and losing it is really scary (I’m sure many of you are feeling that after “Brexit” last week). Those big moves up and down make us react in ways that are generally bad for our long term investment performance. The best advice I can have is to try to not look at your portfolio very often. Maybe a couple times a year or once a month at most; and decide in advance what you are going to do (or not do) and when you are going to do it.

Let’s pretend we have 100k in our 401k with Fidelity, where should we put it?

1) Max any Matching

401k matching is free money. Of course ever article ever written about 401Ks says to do this. For some people it’s really hard because they are living on every dollar they earn. Still… if you can, cut things out of your budget… maybe that coffee in the morning or go out to eat less or whatever. If your employer has a match not only do you get double dollars, you also get them Tax free AND you get to avoid taxes on the compounding earnings over many decades (assuming you are younger).

A strategy I used when I was younger was upping it by 1% every 6 months to a year. A 1% pretax drop in my pay isn’t that noticeable, but over 3-4 years it increases contributions to 5%+ and that can have a HUGE impact over 30 years. It’s the boiling frog, but in this case it makes you richer instead of killing you :).

2) Define your risk tolerance and asset allocation.

This can be really tricky for people. Traditionally it comes down to stocks, bonds and cash. Since cash is elsewhere, the 401k really comes down to stocks and bonds. My suggesting is if you don’t know what your risk tolerance is and you are going crazy thinking about whether the market is high or low or if you should subtract your age from 120 and then set your % or if you’re a little older now, or if the bond market is overpriced. I’d keep it simple and just take 70/30 stocks/bonds and start from there.

3) Focus on fees.

When I look at which investments to make I use fees as the #1 filter. Here’s why.

Assume you have 100k in your 401k and assume that on average it will return 4% inflation adjusted a year for the next 30 years.

That initial 100k represents a “job” that “pays” you $4,000/year.

I think of fees as a “tax” on my INCOME as opposed to a cost on the PRINCIPAL. So when I evaluate fee impact I don’t do this:

100,000 * (1% fee) = 1000/year. “Wow. That’s only 1% of my money, that doesn’t seem like much.”

I do this

$4,000 income from job / $1,000 fee = 25%. “Hang on. The fund is taking 25% of my money? That seems really high.”

I’m convinced that second way is the way to evaluate ANY investment service that take a % of your money.

LET’S MAKE OUR CHOICES

So we have 70k to put in stocks and 30k to put in bonds, which ones?

STOCK SELECTION

So my first goal is to find the funds with the lowest fees.

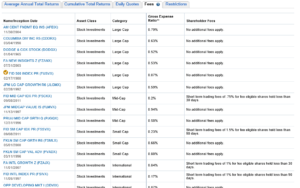

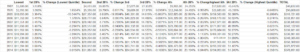

Fidelity lets me do this pretty easily as I can browse the investment choices and show the fees in a nice list (they don’t let me sort by fees, so it’s a bit more work). Here’s what it looks like: